Bitcoin for America Act would let US taxpayers pay federal taxes in BTC

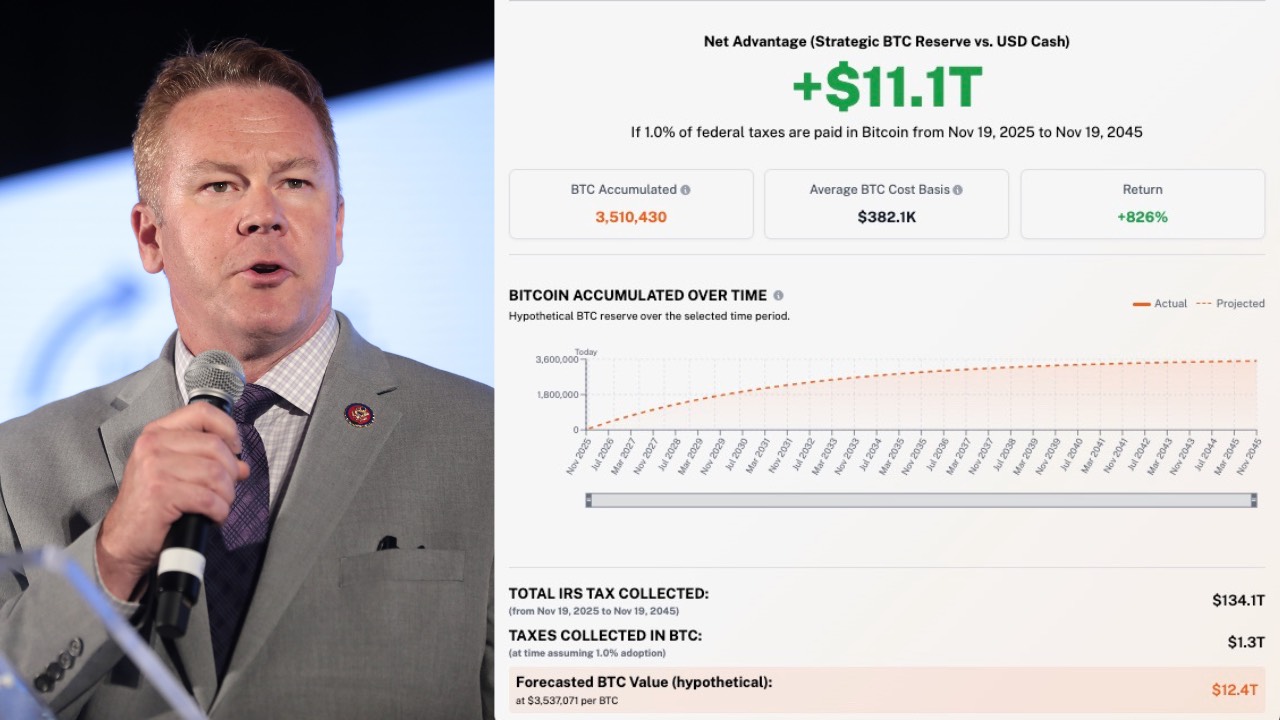

New bill from Rep. Warren Davidson would let Americans pay federal taxes in Bitcoin and route those coins into a Strategic Bitcoin Reserve, pitching BTC as a long-term hedge on the US balance sheet rather than something to dump for dollars.

Bitcoin-friendly congressman Rep. Warren Davidson (R-OH) has introduced a “Bitcoin for America Act” that would let Americans pay federal taxes in BTC and route those coins into a new Strategic Bitcoin Reserve.

The bill is pitched as a way to modernize tax collection, give taxpayers another payment rail, and put Bitcoin on the federal balance sheet as a reserve asset rather than selling it for dollars. Instead of immediately converting those BTC to fiat, the Treasury would hold them in a dedicated reserve, framed as protection against inflation and long-term fiscal risk.

Davidson argues that Bitcoin’s fixed 21 million supply and track record versus inflationary currencies make it a better long-term store of value than the dollar. The press release leans heavily on the idea that the U.S. should lead, not follow, as other countries build up strategic Bitcoin positions. China and Russia are name-checked as examples of nations already accumulating BTC.

The proposal also has a political and access angle. Davidson claims that letting people pay in BTC expands participation in the tax system, especially for the under-banked who may be more comfortable with Bitcoin than with legacy banking rails. Routing BTC into a Strategic Bitcoin Reserve is positioned as a way to strengthen the national balance sheet and reduce reliance on additional debt issuance.

For now this is an opening bid, not law. The bill would still have to move through committee, survive amendments, and clear both chambers. It also raises practical questions: how custody would be handled, what accounting rules Treasury would follow, whether BTC holdings would be marked-to-market, and how this interacts with existing rules around public-sector investment in “volatile” assets.

For operators, allocators, and miners, the signal is what matters: a sitting U.S. Representative is explicitly proposing to park a slice of federal tax receipts in Bitcoin instead of selling them. Even if this specific bill dies, it moves the Overton window on Bitcoin as a strategic reserve asset. If a future version ever passes, it would turn the IRS and Treasury into structural BTC buyers whenever taxpayers opt to pay in Bitcoin.

More from the Policy desk

Open desk →